The Accounting Cycle

Here, Accounting starts with recording transactions. The transactions may be of any activity or event that includes your business.Here we have given some of the concepts of accounting. They are as follows: To form up a firm foundation of how accounting works, then an individual must understand several conceptual issues. These basic accounting conceptions are as follows:

- Accruals concept

- Conservatism concept

- Consistency concept

- Economic entity concept

- Matching concept

- Materiality concept

Accruals concept

Income will be recognized when procured, and expenses are recognized when resources are spent. This idea implies that a business might recognize income, benefits, and losses in amounts that fluctuate from what might be received depending on the money got from clients or when money is paid to providers and representatives. Reviewers will just affirm the budget reports of a business that have been arranged under the idea of the accumulation.

Conservatism concept

Income is known when there is a reasonable certainty that it will be acknowledged, though expenses are known faster when there is a reasonable chance that they will be brought about.

Consistency concept

When a business decides to utilize a particular accounting strategy, it should keep utilizing it on a go-forward basis. Thusly, fiscal reports ready in different periods can be dependably thought about.

Economic entity concept

The transactions of a business are to be kept separate from those of its proprietors. So, there is no mixing of individual and deals in an organization's budget statement.

Matching concept

The costs related to income ought to be recognized in a similar period wherein the income was identified. By doing this, there is no rearrangement of cost recognition into later detailing periods, so somebody seeing an organization's budget statement can be guaranteed that all features of a transaction have been recorded simultaneously.

Materiality concept

Transactions ought to be recorded when not doing. So it might change the choices made by a reader of an organization's budget report. This will come as a result of comparatively smaller-size transactions being recorded so that the financial statements widely signify the financial outcomes, financial position, and business’s cash flows.

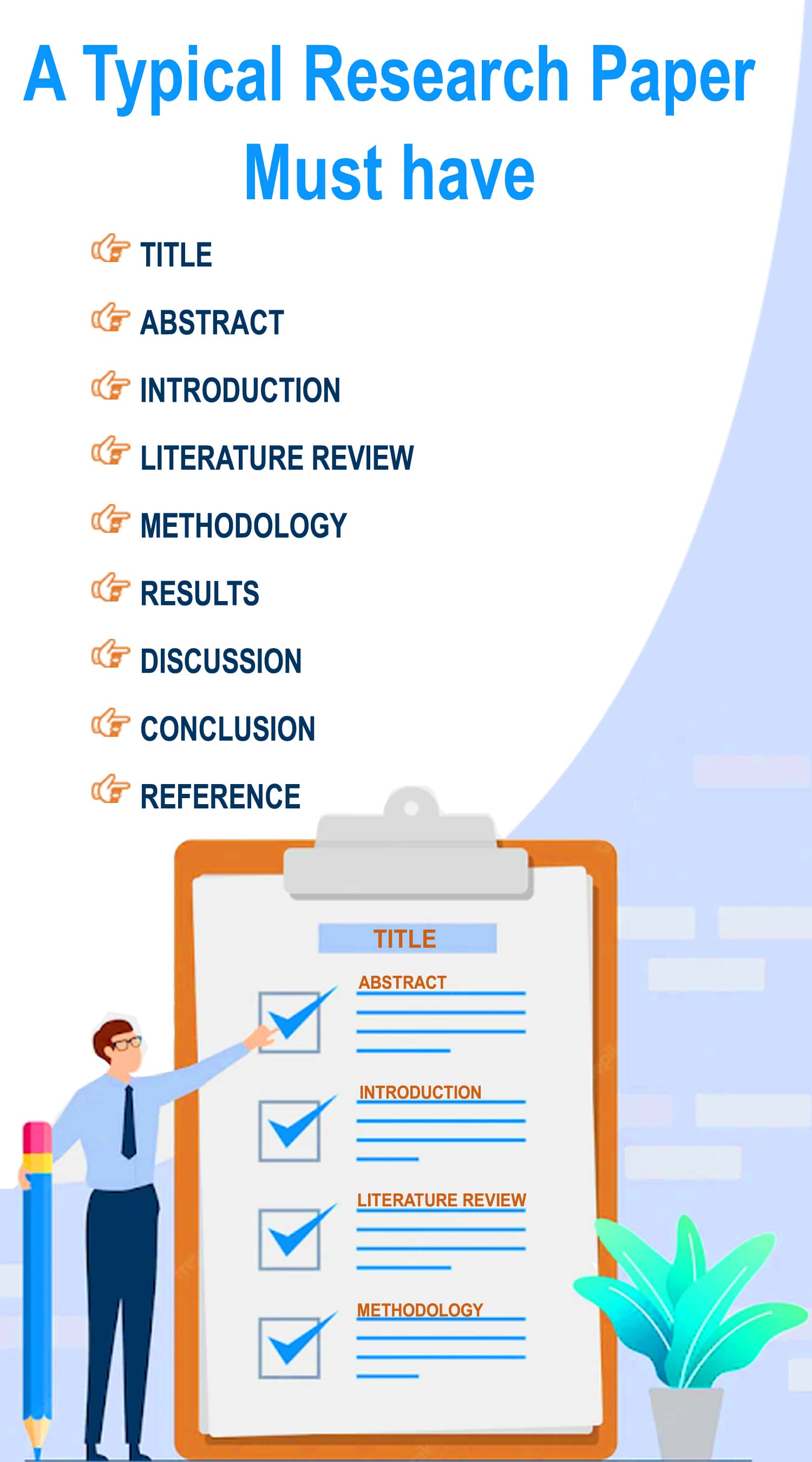

Key Areas of Accounting Research

- Financial Accounting: Focuses on recording, reporting, and analyzing financial information for external users.

- Managerial Accounting: Examines the use of accounting information for internal decision-making and control within organizations.

- Auditing: Investigates the independent examination of financial statements and internal controls.

- Taxation: Studies tax laws, policies, and their impact on individuals and businesses.

- Accounting Information Systems (AIS): Explores the design and use of accounting systems to process and manage financial information.

- Forensic Accounting: Applies accounting principles in legal proceedings, particularly in fraud investigations and litigation support.

- Sustainability Accounting: Focuses on accounting for environmental, social, and governance factors in business decision-making.

Are you seeking assistance in writing your accounts research paper? We are here to provide the best and most customised assistance in research paper writing and every stage of your research! Talk with our experts to know more Clik here to call

Merits and Demerits of Accounting

Merits

- Maintenance of business records

- Memory replacements

- Evidence in legal matters

- Business evaluation

- Decision making

Demerits

- Management of accounts

- Express accounting information in terms of money

- Accounting information may be unfair

- Accounting information is based on estimates

- Manipulation of Accounts

| Maintaining systematic records |

Business transactions must be properly recorded, and it should be classified under proper accounts and summarized into financial declarations. |

| Protecting and correctly controlling the business properties. |

This plays an important role in protecting and preventing your organization’s resources from fraudulent activities. |

| Ascertainment of profit or loss. |

Every business requires to make financial reports to determine the consequences of its financial operations |

| Facilitating decision making |

In the process of facilitating decision-making, the ratio, the emotions, and your role as a facilitator must be considered. |

Whatsapp communication- +919940955256

Whatsapp communication- +919940955256 Fresh Research Paper

Fresh Research Paper Rewrite Your Research Paper

Rewrite Your Research Paper Immediate Enquiry - +916382814563

Immediate Enquiry - +916382814563